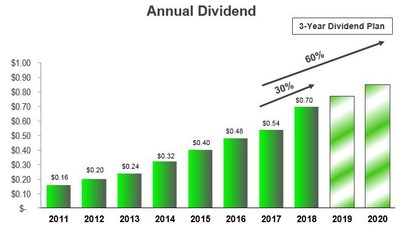

PolyOne Declares Quarterly Dividend Increase of 30%, Announces Three-Year Dividend Increase Plan

October 12, 2017

"In the last six months we have taken important steps to strengthen our portfolio as we divested DSS and reinvested the proceeds to fund the acquisitions of

"We initiated our dividend in 2011, and we have increased it annually ever since," Mr. Patterson added. "With the structural improvements in our portfolio and increased confidence in our future earnings growth, we are pleased to announce this latest increase, which is our largest ever. It is the first in a plan that we anticipate will increase our dividend 60% or more cumulatively over the next three years."

"We view the increased payouts as a balanced element of delivering value to our shareholders, as our payout ratio remains modest at approximately 30%. As we look ahead, the preponderance of our cash flow will continue to go toward funding organic growth initiatives and acquisitions that accelerate our specialty growth. We will also be opportunistic with respect to buying back shares," Mr. Patterson further stated. "We are very excited about our growth opportunities and remain fully committed to investing in our businesses through innovation, commercial and technical resources and M&A, as we execute our four-pillar strategy to serve our customers."

About

Forward-looking Statements

In this press release, statements that are not reported financial results or other historical information are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements give current expectations or forecasts of future events and are not guarantees of future performance. They are based on management's expectations that involve a number of business risks and uncertainties, any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. They use words such as "will," "anticipate," "estimate," "expect," "project," "intend," "plan," "believe," and other words and terms of similar meaning in connection with any discussion of future operating or financial condition, performance and/or sales. Factors that could cause actual results to differ materially from those implied by these forward-looking statements include, but are not limited to: our ability to realize anticipated savings and operational benefits from the realignment of assets, including the closure of manufacturing facilities; the timing of closings and shifts of production to new facilities related to asset realignments and any unforeseen loss of customers and/or disruptions of service or quality caused by such closings and/or production shifts; separation and severance amounts that differ from original estimates; amounts for non-cash charges related to asset write-offs and accelerated depreciation realignments of property, plant and equipment that differ from original estimates; our ability to identify and evaluate acquisition targets and consummate acquisitions; the ability to successfully integrate acquired businesses into our operations, such as

We undertake no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to consult any further disclosures we make on related subjects in our reports on Form 10-Q, 8-K and 10-K that we provide to the

View original content with multimedia:http://www.prnewswire.com/news-releases/polyone-declares-quarterly-dividend-increase-of-30-announces-three-year-dividend-increase-plan-300536115.html

SOURCE

Investor Relations: Eric R. Swanson, Director, Investor Relations, PolyOne Corporation, +1 440-930-1018, eric.swanson@avient.com, Media: Kyle G. Rose, Vice President, Corporate Communications, PolyOne Corporation, +1 440-930-3162, kyle.rose@avient.com